Expert in Accouting (Basic to Advance)

Your next steps will depend on your interests, career goals, and the level of expertise you want to develop.

Karan Singh

350+ Hours

500+ Lessons

Thanks for showing interest

Please feel out the form below.

Validity

2 Years

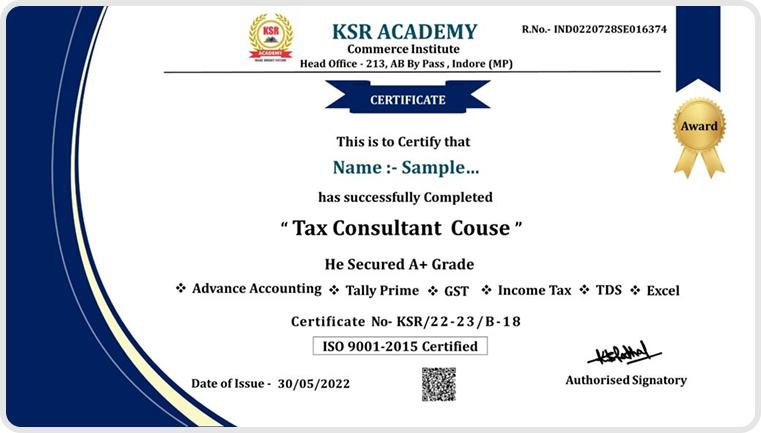

Certificate

YES

Module

1 Module

Course Description

अगर आप Non- Commerce Background से है व् Commerce Background से हे लेकिन Accounting and tally me expert नहीं है।

आप Accounting and taxation filed में अपना उज्जवल भविष्य बनाना चाहते है तो Tax Consultant Course (Basic to Advance) सिर्फ आपके लिए है.

Course Features

- सभी कोर्सेस सरल हिंदी भाषा में

- बेसिक से एडवांस कोर्सेस

- कोर्स प्रैक्टिस फाइल्स उपलब्ध

- कोर्स कम्पलीशन सर्टिफिकेट

- इंस्टेंट एक्सेस

- Offline Downloading Video Facility Available

सभी Lecture Recoded है। अगर आपको कुछ Doubt आता हे हर Saturday Night 9 PM बजे Live Doubt Session होता है जिसमे आप अपने Doubt पूछ सकते है

सभी Subject के Lecture Duration wise निचे दिए गए है

सभी Subject के PDF Notes download करके Print करवा सकते है

What we will Learn in this Course ?

- How to Prepare Trading Account from Trail Balance

- Prepare Balance Sheet

- Finalization of Balance sheet

- Proprietorship Balance Sheet Finalisation

- Partnership Firm Accounting

- Partners Capital Account

- Company Accounting

- Balance sheet as per schedule 3

- Manufacturing Business Accounting

- Trading Business Accounting

- Service Business Accounting

- Shop Accounting

Extra Benefit

- Practical back Support

- Live Doubt Session

- Fully Practical Course

- Downloadable Notes

- Course Completion ISO Certificate

Why Choose Our Tax Consultant Course?

- Accountant

- Non-Commerce

- B.com graduate

- MBA Passout

- LLB Students

- Tax Consultant

- CA Students

- CMA/CS Students

Key Features

- 500+ Lessons with Practice File

- 350+ Hours Course

- Mobile and Laptop Access

- WhatsApp Back Support

- 100% Practical Course

- Downloadable Notes

- Multiple Validity

- Unlimited View Watch Any Time

Module cover

Basic Account

Advance Accounting & Balance Sheet Final

What will you Learn in this Course

- Intrdouction of Account

- How To Record Tranasction

- 5 Pillar of Account

- How Many Trasaction in Business

- Ledger Posting

- How To Prepare Balance Sheet and Trading and P &L

Proprietorship – Balance Sheet Finalization

- Opening Balance Match with audited Data

- Ledger Scrutiny and Document Required

- Loan Interest Adjustment

- How to Create and Adjust Provision

- Cash Entry and Negative Balance Adjustment

- How to Match Tally Data with 26AS , TIS & AIS Report

- GST Match – Tax Liabilities and ITC comparison

- GST Match – Tally Data Match with GSTR-2B

- Setoff Output Tax against Input Tax Entry in Tally Prime Part-1

- How to Calculate Depreciation and Entry in Tally Prime

- Raw material convert into Finished Goods Entry in Tally Prime

- How to Adjust Gross Profit and Net profit by Closing Stock

- Partnership Firm Balance Sheet Scrutiny

- Match Electronic Cash Ledger in Tally Prime

- Match Electronic Credit Ledger in Tally Prime

- Match Input Tax Ledger in Tally Prime

- TDS & TCS adjust against Income Tax Payable

- Adjustment Entry in Partner Capital Account

- Prepare Trading & profit and Loss Account in Excel Format

Partnership – Balance Sheet Finalization

- P & L Appropriation ac Partnership

- Admission of Partner Partnership Account

- Retirement of Partner Partnership Account

- Capital Account in Tally Prime Partnership account

- Partner’s Remuneration And How It Is Calculated?

- Registration of Partnership Firm

- Opening Balance Match with audited Data

- Ledger Scrutiny and Document Required

- Loan Interest Adjustment

- How to Create and Adjust Provision

- Cash Entry and Negative Balance Adjustment

- How to Match Tally Data with 26AS , TIS & AIS Report

- GST Match – Tax Liabilities and ITC comparison

- GST Match – Tally Data Match with GSTR-2B

- Setoff Output Tax against Input Tax Entry in Tally Prime Part-1

- How to Calculate Depreciation and Entry in Tally Prime

- Raw material convert into Finished Goods Entry in Tally Prime

- How to Adjust Gross Profit and Net profit by Closing Stock

- Partnership Firm Balance Sheet Scrutiny

- Match Electronic Cash Ledger in Tally Prime

- Match Electronic Credit Ledger in Tally Prime

- Match Input Tax Ledger in Tally Prime

- TDS & TCS adjust against Income Tax Payable

- Adjustment Entry in Partner Capital Account

- Prepare Trading & profit and Loss Account in Excel Format

- Partners Capital Account

Company – Balance Sheet Finalization

- What is Company and Types of Company

- What is OPC ? Difference Between OPC and Sole Proprietor

- What is Private Limited Co ? Difference Between OPC and Private Limited

- What is Public Limited Co. ? Difference Between Pvt ltd and Public Ltd

- What is Share ? Equity Share and Preference Share

- What is Debenture ? Difference between Share and Debenture

- What is Deferred Tax Assets and How to Calculate

- Depreciation Calculation as Per Income Tax Act(WDV Method)

- Depreciation Calculation as Per Company Act 2013 (SLM Method)

- Balance Sheet as per schedule 3 in Excel

What will you Learn in this Course

Why Students Love KSR Academy

Whether it’s a first brush on canvas or the last frame in an animation, Skillshare is here to support you on every step of your creative journey.

Awesome teaching ...“Thank you, sir, for being so interactive with us that the concepts that seem so difficult in the textbooks begin to feel easy and applicable when you teach them.Thanks to KSR academy

Sandip Malge

The way of teaching of KSR Academy was just a extraordinary experience for me.... I always suggest for any interested students want to join in a courses of Tax Consultant.... Please prefer first KSR 👍👍❤

Bishikeshan Ratha

Hello sir 1st off thank you so much sir for such a wonderful course with affordable price for such students who are not able to afforded such course due high price in market. The way you teach was best very concept get crystal clear you are best teacher for this course . Thank you sir.

Poonam Narawade

Here is the best class for GST taxation and accounting.Here karan sir your teaching technique is good from very basic and advance knowledge level. This knowledge will help me to brighten my future. Thank you ou so much Karan sir..

Akshaykumar nigade

Awesome teaching and the Best class for GST , Taxation and Accounting. Karan Sir is very helpful and interactive Person. It is so easy to understand difficult concepts through your interactive classes. He helps Always after the class also and clears all the doubts. ❤️"I Proud To Be A Part Of KSR Academy".💐 Thanks to KSR Academy🙏🏻

AMIT KUMAR

Very nice experience. This is a fully knowledgeable course. In this course you can understand all things regarding tax consultant and accountancy from beginner to advance level.

Nitesh Singla

Nice Teaching with each and every subject of accounting and taxation with fully understood, systematic training in practical and theoretical knowledge, Teacher must to solve the all types of problems and our queries with proper explanation helping in accounting and taxation. Nice class with excellent experience with this class.

Ajinkya dhawale

Frequently Asked Questions

Click on Enroll Now Button. > Clicking the Course Page will Open> Click on Get this course. > Fill Detail and Verify Mobile number with Mobile OTP. > Make payment via UPI, Debit card and Credit Card> After payment you will get access immediately.

Yes ! You can Download Videos in Mobile Application, You Can watch it in Offline Mode without Internet.

For Laptop or PC Visit www.ksracademy.com >click on Login > Enter your Registered mobile number > Verify OTP with Registered Mobile Number.

Yes ! you will have our WhatsApp support.

The validity of the course is 10 Years.

Yes, you will get Accounting, Tally Prime eBook and practice file.

Yes ! You will Get A Certificate.

There is No Refund Policy.

There will be a live doubt session once a week

Get Bonuses Worth ₹ 8,500 with this Course

Excel Mastery Course

Basic Excel with Pivot Table, V lookup , H-Lookup and many Advance Formula

Word Mastery Course

Microsoft Word with Basic to Advance Letter Writing , Printing option etc

Power point Mastery Course

Power Point Presentation Prepare Create Youtube Thumbnail, Instragram Post