GSTR-9 & 9C Return Filling

Master the complete process of filing GSTR-9 & GSTR-9C with practical training, real examples, and latest GST updates.

Karan Singh

350+ Hours

500+ Lessons

Validity

18 Month

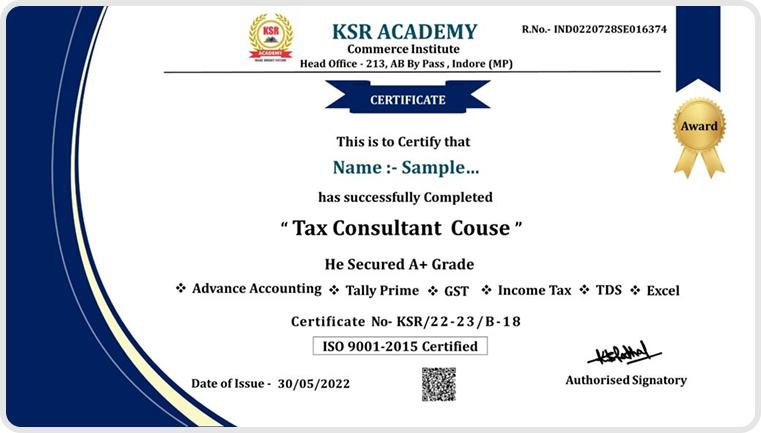

Certificate

YES

Module

1 Module

Course Description

अगर आप Non- Commerce Background से है व् Commerce Background से हे लेकिन Accounting and tally me expert नहीं है।

आप Accounting and taxation filed में अपना उज्जवल भविष्य बनाना चाहते है तो Tax Consultant Course (Basic to Advance) सिर्फ आपके लिए है.

जिसमे आप Total 9 Module सीखेंगे.जो Zero level से शुरू होंगे व Advance Level तक कवर होंगे.This course is designed to provide in-depth knowledge and practical training on annual GST compliance through GSTR-9 and GSTR-9C filing. It is ideal for accountants, tax professionals, and business owners who want to ensure accurate GST reporting and avoid compliance issues.

What You Will Learn:

Overview of GSTR-9 and 9C: applicability, due dates, and requirements

Detailed structure and components of GSTR-9 (Annual Return)

Reconciliation between books of accounts and GST returns

Preparation and filing of GSTR-9C (Reconciliation Statement & Audit)

Common errors, mismatches, and their rectifications

Practical case studies with real-time data

Compliance tips to avoid notices and penalties

Key Features:

Step-by-step practical training

Real examples and hands-on filing guidance

Covers latest GST rules, updates, and amendments

Easy language with detailed explanations

Useful for both beginners and experienced professionals

Who Should Enroll:

Accountants and tax return preparers

CA/CMA/CS aspirants and professionals

Business owners and finance managers

Anyone responsible for GST compliance in organizations

Key Features

- Daily Live Doubt Clearing Session

- 19+ Lessons with Practice File

- 10+ Hours Course

- Mobile and Laptop Access

- WhatsApp Back Support

- 100% Practical Course

- Downloadable Notes

- 18 Month Validity

- Unlimited View Watch Any Time

What will you Learn in this Course

- Lec-1 GSTR-9 Part-1 Applicability & Basic of GSTR-9 for FY 23-24

- Lec-2 GSTR-9 Part-2 Penalty on Non Filing of GSTR 9 for FY 2023-24

- Lec-3 GSTR-9 Part-3 Overview of Tables of GSTR 9 FY 2023-24

- Lec-4 GSTR-9 Part-4. Optional Table in GSTR-9

- Lec-5 GSTR-9 Part-5 Table -4 Outward Supply

- Lec-6 GTSR-9 Part- 6. Adjustment in Table -4 Of FY 2023-24 in FY 2024-25

- Lec-7 GSTR-9 Part-7 Table No-5 Sales n which Tax is Not Payable

- Lec-8 GSTR-9 Part-8 Table No-6 ITC availed during the financial year

- Lec-9 GSTR-9 Part-9 Table 7-8 ITC Reverse and ITC Reconciliation

- Lec-10 GSTR-9 Part-10 Table No-9 Tax Paid as Declared in Return

- Lec-11 GSTR-9 Part-11 Table No-10,11,12,13 and 14

- Lec-12 GSTR-9 Part-12 Table No-15 & 16 Demand & Refund , Purchase from Composition Dealer

- Lec-13 GSTR-9 Part-13 Table No-17 HSN and SAC Wise Details

- Lec-14 GSTR-9 Part-14 Table No-18 and 19 Late Fees Payable Compute

- Lec-15 GSTR-9 Part-15 Practical Return Filling on GST Portal

- Lec-16 GSTR-9 Part-16 GSTR-9 Verify with EVC

- Lec-17 GSTR-9C Part-1 Applicability and Overview of GSTR-9C

- Lec-18 GSTR-9C Part-2 How to Download Offline Excel utility of GSTR-9C

- Lec-19 GSTR-9C Part-3 GSTR-9C Filling All Table

What will you Learn in this Course

Why Students Love KSR Academy

Whether it’s a first brush on canvas or the last frame in an animation, Skillshare is here to support you on every step of your creative journey.

Awesome teaching ...“Thank you, sir, for being so interactive with us that the concepts that seem so difficult in the textbooks begin to feel easy and applicable when you teach them.Thanks to KSR academy

Sandip Malge

The way of teaching of KSR Academy was just a extraordinary experience for me.... I always suggest for any interested students want to join in a courses of Tax Consultant.... Please prefer first KSR 👍👍❤

Bishikeshan Ratha

Hello sir 1st off thank you so much sir for such a wonderful course with affordable price for such students who are not able to afforded such course due high price in market. The way you teach was best very concept get crystal clear you are best teacher for this course . Thank you sir.

Poonam Narawade

Here is the best class for GST taxation and accounting.Here karan sir your teaching technique is good from very basic and advance knowledge level. This knowledge will help me to brighten my future. Thank you ou so much Karan sir..

Akshaykumar nigade

Awesome teaching and the Best class for GST , Taxation and Accounting. Karan Sir is very helpful and interactive Person. It is so easy to understand difficult concepts through your interactive classes. He helps Always after the class also and clears all the doubts. ❤️"I Proud To Be A Part Of KSR Academy".💐 Thanks to KSR Academy🙏🏻

AMIT KUMAR

Very nice experience. This is a fully knowledgeable course. In this course you can understand all things regarding tax consultant and accountancy from beginner to advance level.

Nitesh Singla

Nice Teaching with each and every subject of accounting and taxation with fully understood, systematic training in practical and theoretical knowledge, Teacher must to solve the all types of problems and our queries with proper explanation helping in accounting and taxation. Nice class with excellent experience with this class.

Ajinkya dhawale

Frequently Asked Questions

Click on Enroll Now Button. > Clicking the Course Page will Open> Click on Get this course. > Fill Detail and Verify Mobile number with Mobile OTP. > Make payment via UPI, Debit card and Credit Card> After payment you will get access immediately.

Yes ! You can Download Videos in Mobile Application, You Can watch it in Offline Mode without Internet.

For Laptop or PC Visit www.ksracademy.com >click on Login > Enter your Registered mobile number > Verify OTP with Registered Mobile Number.

Yes ! you will have our WhatsApp support.

The validity of the course is 18 Month.

Yes, you will get Accounting, Tally Prime eBook and practice file.

Yes ! You will Get A Certificate.

There is No Refund Policy.

There will be a live doubt session Monday to Friday 8PM.