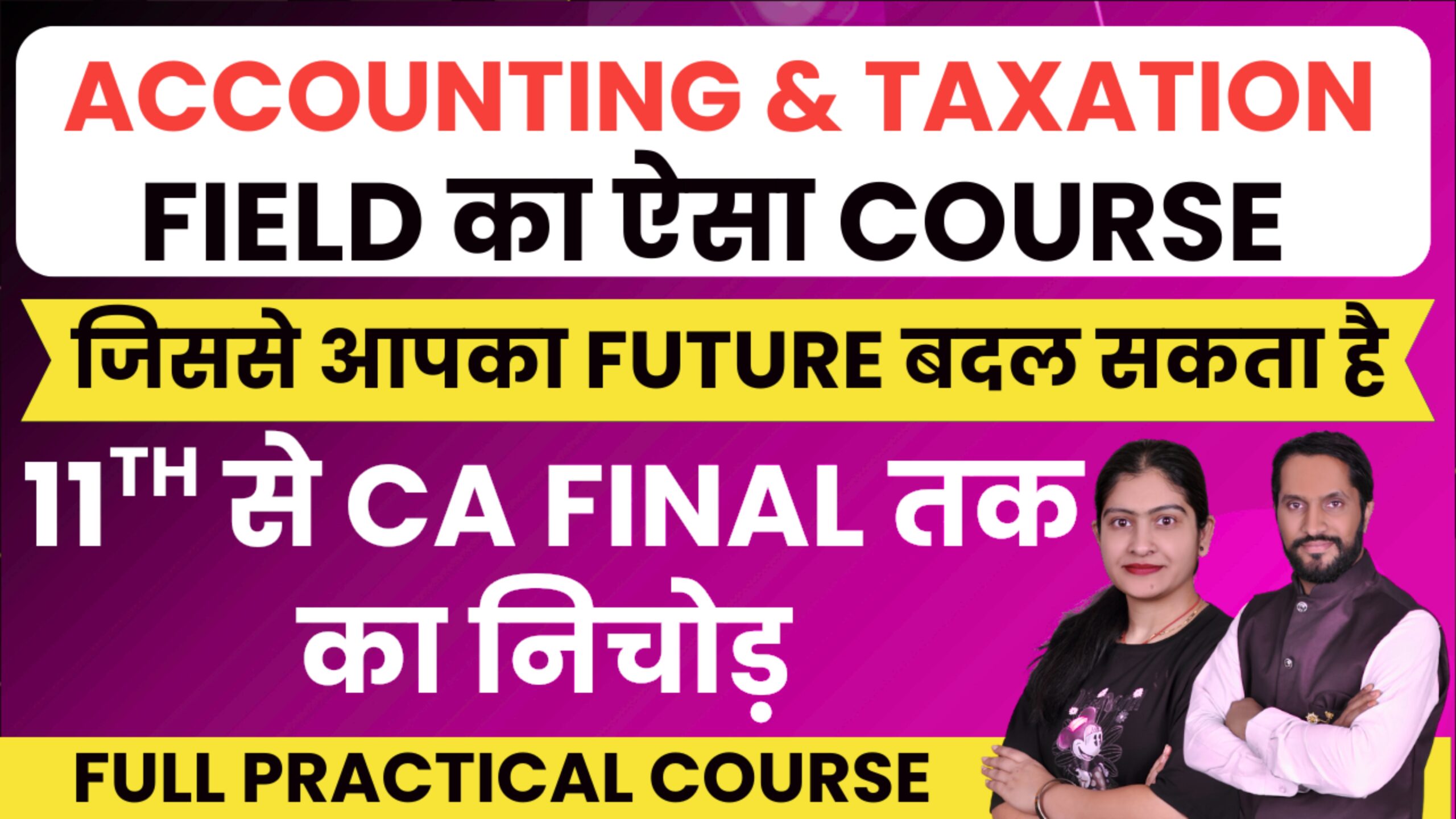

Make bright future in accounting and taxation field with us

Tax Consultant Course

Your journey in taxation begins here—choose the path that matches your interests, career goals, and desired level of expertise.”

Karan Singh

350+ Hours

500+ Lessons

Thanks for showing interest

Please feel out the form below.

Validity

Life Time Validity

Certificate

YES

Module

9 Module

Why Should you join Tax Consultant course ?

Our Tax Consultant Course is designed for students, professionals, and entrepreneurs who want to build a career in Income Tax, GST, TDS, Accounting, and Tax Planning. This program provides not only practical knowledge of taxation but also equips you to establish yourself as a successful Tax Practitioner or Consultant.

Key Highlights of the Course

- Practical Training – Hands-on practice in GST filing, Income Tax Return filing, TDS, PAN/TAN application, and more.

- Updated Curriculum – Based on the latest tax laws, policies, and compliance requirements.

- Expert Faculty – Learn directly from experienced industry professionals.

- Career Opportunities – Open doors to roles like Tax Consultant, GST Practitioner, Accountant, or Financial Advisor.

- Certification – Receive a recognized certificate upon successful completion of the course.

Who Can Join?

- Students from commerce, law, or finance backgrounds (B.Com, M.Com, CA, CS, LLB, etc.)

- Working professionals in accounting, finance, or taxation

- Entrepreneurs and small business owners

- Anyone looking to start a career in Accounting and taxation

Key Features

- 3 Live Doubt Session in week at 8 PM

- 650+ Lessons with Practice File

- 100% Practical Course

- 350+ Hours Course

- Downloadable Notes

- Mobile and Laptop Access

- Multiple Validity

- Unlimited View Watch Any Time

Why Choose Our Tax Consultant Course?

Practical, Hands-On Learning

Get real-world training in GST, Income Tax, TDS, and compliance filing.

Get ISO Certificate

Receive a recognized certificate to boost your career credibility.

Doubts Solution Support

Also, you can ask all your doubts after attending the daily lessons. Our team will solve each and every problem.

Career Growth

Open opportunities as a Tax Consultant, GST Practitioner, Accountant, or Finance Advisor.

What will you Learn in this Course ( CONTENT)

- Lec-1 What is Accounting ? Introduction of Account

- Lec-2 How Many Person do Business

- Lec-3 How to record Transaction ? Golden Rule of Account

- Lec-4 5 Pillars of Account Part-1

- Lec. 5. 5 Pillars Of Account Part-2

- Lec-6 How Many Transaction of Business Part-1

- Lec-7 How Many Transaction of Business Part-2

- Lec-8 Ledger Posting

- Lec-9 How to Prepare Trail Balance

- Lec-10 How To Prepare Trading and Profit and Loss Account

- Lec-11 How to Prepare Balance Sheet

- Lec-12 How To Prepare Trading and Profit and Loss Ac and Balance sheet from Trail balance

- Lec-1 Introduction of Tally Prime

- Lec-2 How to Download Tally Prime

- Lec-3 How to Create Company , Alter, Shut , Change in Tally Prime

- Lec-4 Ledger Create, Alter and Delete in Tally Prime

- Lec-5 Group Creation in Tally Prime

- Lec-6 Practical Opening Balance enter in Tally Prime

- Lec-7 Voucher Entry -F4 Contra

- Lec-8 Voucher Entry – F5 Payment and F6 Receipt

- Lec-9.Voucher Entry -F9 Purchase and F8 Sales (without Inventory )

- Lec-10 Voucher Entry -F7 Journal Voucher

- Lec-11 Advance Feature in Voucher Entry

- Lec-12 Inventory Master – Item, UOM, Group, Create, Alter / Delete

- Lec-13 Sales & Purchase Record with Inventory

- Lec-14 Bank Statement Entry in Tally Prime

- Lec-15 What is GST ? GST Registration Limit ? Who Charge GST on Goods

- Lect-16 What is Intra State and Inter State Purchase & Sales

- Lec-17- Types of Tax | What is IGST,CGST,SGST

- Lec-18 What is Input and Output Tax in GST

- Lec-19 What is Input tax Credit

- Lec-20 How to Activate GST in Tally Prime

- Lec-21 How to Create GST Ledger

- Lec-22 Create Debtors and Creditors Ledger

- Lec-23 GST Tax Rate Setup in Stock Item and Stock Group

- Lec-25 How to Record Sales Invoice with GST

- Lec-26 How to Charge GST on Freight Charges in Purchase and sales Invoice with Stock Item

- Lec-27 Trade Discount and Cash Discount Entry in Purchase and Sales Invoice

- Lec-28 How to Deactivate Item Allocation Option in Stick Item

- Lec-29. Buy 5 Get one Free Offer Entry in Sale Invoice

- Lec-30 Free sample using zero-valued transaction in Sales Invoice

- Lec-31 Specify Separate Buyer (Bill to) and Consignee (Ship to) details

- Lec-32 What is Debit Note ? When Issue and Record Debit Note in Tally Prime

- Lec-33 What is Credit Note ? When issue and Record Credit Note in Tally Prime

- Lec-34 How to Record Purchase of Fixed Assets/Capital Goods Under GST

- Lec-35 Record Expenses with GST in Purchase, Payment or Journal Voucher

- Lec-36 Voucher Class in sales and purchase (Speed Transaction Record)

- Lec-37 Inclusive of Tax of Item Option in Sale Invoice (Walking Client Business)

- Lec-38 Create Sales Invoice without Party Ledger Create (Shop Accounting)

- Lec-39 How to Give Quotation to Walking Client without Ledger Create

- Lec-40 What is RCM ? How to Pay GST via RCM

- Lec-41 RCM Entry in Tally Prime | RCM on Freight Charges Entry

- Lec-42 Batch Wise ( IMEI) Stock Maintain | Electric Shop Accounting

- Lec-43 Report – Trail Balance & Day Book

- Lec-44 Report – Cash Book and Bank Book| How to check Day wise Negative Cash Balance

- Lec-45 Report – Ledger and Group wise Check

- Lec-46 Report -Sales Register and Purchase Register

- Lec-47 Detail Analysis of Trading & Profit and Loss A/c

- Lec-48 Detail Analysis of Balance Sheet

- Lec-49 Details Analysis of Stock Item | Stock Summary

- Lec-50 Bank Reconciliation in Tally Prime

- Lec-51 Print Option | Print sales Invoice | Ledger Party

- Lec-52 Important Short Cut Key | Insert Voucher | Create Ledger Etc

- Lec-53 Stock Journal | Stock Transfer from One Godown to another Godown

- Lec-54 Lecture-52 Tally Data Backup and Restore

- Lec-55 Split Tally Data | How to DATA Split

- Lec-56 How to Send DATA via Mail and Whats App

- Lec-57 How to Open Tally DATA Received by Mail and Whats App

- Lec-59 How to Select DATA Path for Default Company Folder

- Lec-60 Control user Access to Company DATA | Password Create for Open Company

- Lec-61 Tally Data Export in PDF, Excel and JPEG Format

- Lec-62 GST Return | How many types of GST Return

- Lec-63 How to File GSTR-1 Part-1

- Lec-64 GSTR-1 Return Filling on Portal Part-2

- Lec-65 GSTR -1 IFF (Invoices Furnishing Facility)

- Lecture-66 Filing Nil Form GSTR-1 through SMS

- Lec-67 What is GSTR2A and GSTR-2B ,Difference between GSTR2A and 2B

- Lec-68 How to File GSTR-3B on GST Portal

- Lec-69 FD Interest in Tally Prime

- Lec-1 What is Composition Scheme under GST

- Lec-2 How to Activate GST in Tally Prime

- Lec-3 How to Create Tax , Purchase & Sales Ledger and Stock Item

- Lec-4 Record Purchase & Sales invoice under Composition Scheme

- Lec-5 RCM Entry and Increase Output Tax Liability in Tally Prime

- Lec-6 What is CMP -08 Form ? How to Calculate Tax Liability via CMP -08 form In tally Prime

- Lec-1 How to Prepare Trading & Profit and Loss A/c and Balance Sheet

- Lec-2 How to Finalization of Balance Sheet Part-1

- Lec-3 Manual Balance Sheet Final Part-2

- Lec-4 Balance Sheet Final Part-3

- Lec-5 22 Work We have to Do while Balance sheet Final

- Lec-6 Introduction (Must Watch)

- Lec-7 Opening Balance Match with Audited Data

- Lec-8 Opening Balance Match Part-2

- Lec-9 Data Split from 01 April 2024

- Lec.10 Ledger Scrutiny and requirement Document

- Lec-11 PY Provision setoff Against Payment

- Lec-12 Loan Interest Adjustment Part-1

- Lec-13 Loan Interest Adjustment Part-2

- Lec-14 How to Create and Adjust Provision

- Lec-15 Cash Entry and Negative Balance Adjustment

- Lec-16 How to Match Tally Data with 26AS , TIS & AIS Report

- Lec-17 GST Match – Tax Liabilities and ITC comparison

- Lec-18 GST Match – Tally Data Match with GSTR-2B

- Lec-19 Setoff Output Tax against Input Tax Entry in Tally Prime

- Lec-20 Match Input Tax Credit Ledger with Tally Prime

- Lec-21 How to Calculate Depreciation and Entry in Tally Prime

- Lec-22 Raw material convert into Finished Goods Entry in Tally Prime

- Lec-23 How to Adjust Gross Profit and Net profit by Closing Stock

- Lec-24 How to Adjust Advance Tax , TCS & TDS against Income Tax Payable for PY

- Lec-25 Prepare Balance Sheet in Excel as per Schedule -3 Part-1

- Lec-26 Prepare Balance Sheet in Excel as per Schedule -3 Part-2

- Lec-1 Introduction of Partnership Account

- Lec-2 P & L Appropriation ac Partnership

- Lec-3 Guarantee of Profit to a Partner Partnership

- Lec-4 Admission of Partner Partnership Account

- Lec-5 Retirement of Partner Partnership Account

- Lec-6 Capital Account in Tally Prime Partnership account

- Lec-7 Partner’s Remuneration And How It Is Calculated?

- Lec-8 Type of Partnership Firm

- Lec-9 Type of Partner

- Lec-10 Registration of Partnership Firm

- Lec-11 LLP registration

- Lec-12 Introduction of Balance sheet

- Lec-13 Opening Balance Match with audited Data

- Lec-14 Ledger Scrutiny and Document Required

- Lec-15 Loan Interest Adjustment Part-1

- Lec-16 Loan Interest Adjustment Part-2

- Lec-17 How to Create and Adjust Provision

- Lec-18 Cash Entry and Negative Balance Adjustment

- Lec-19 How to Match Tally Data with 26AS , TIS & AIS Report

- Lec-20 GST Match – Tax Liabilities and ITC comparison

- Lec-21 GST Match – Tally Data Match with GSTR-2B

- Lec-22 Setoff Output Tax against Input Tax Entry in Tally Prime Part-1

- Lec-23 Setoff Output Tax against Electronic Credit and Cash Ledger in Tally Prime Part-2

- Lec-24 How to Calculate Depreciation and Entry in Tally Prime

- Lec-25 Raw material convert into Finished Goods Entry in Tally Prime

- Lec-26 How to Adjust Gross Profit and Net profit by Closing Stock

- Lec-27 Partnership Firm Balance Sheet Scrutiny

- Lec-28 Match Electronic Cash Ledger in Tally Prime

- Lec-29 Match Electronic Credit Ledger in Tally Prime

- Lec-30 Match Input Tax Ledger in Tally Prime

- Lec-31 TDS & TCS adjust against Income Tax Payable

- Lec-32 Adjustment Entry in Partner Capital Account

- Lec-33 Prepare Trading & profit and Loss Account in Excel Format Part-1

- Lec-34 Prepare Balance Sheet with Schedules in Excel Format

- Lec-35 Prepare Partner Capital Account in Excel Format

- Lec-1 What is Company and Types of Company

- Lec-2 What is OPC ? Difference Between OPC and Sole Proprietor

- Lec-3 What is Private Limited Co ? Difference Between OPC and Private Limited

- Lec-4 What is Public Limited Co. ? Difference Between Pvt ltd and Public Ltd

- Lec-5 What is Share ? Equity Share and Preference Share

- Lec-6 What is Debenture ? Difference between Share and Debenture

- Lec-7 Introduction of Balance sheet

- Lec-8 Opening Balance Match with audited Data

- Lec-9 Ledger Scrutiny and Document Required

- Lec-10 Loan Interest Adjustment Part-1

- Lec-11 Loan Interest Adjustment Part-2

- Lec-12 How to Create and Adjust Provision

- Lec-13 Cash Entry and Negative Balance Adjustment

- Lec-14 How to Match Tally Data with 26AS , TIS & AIS Report

- Lec-15 GST Match – Tax Liabilities and ITC comparison

- Lec-16 GST Match – Tally Data Match with GSTR-2B

- Lec-17 Setoff Output Tax against Input Tax Entry in Tally Prime Part-1

- Lec-18 Setoff Output Tax against Electronic Credit and Cash Ledger in Tally Prime Part-2

- Lec-19 How to Calculate Depreciation and Entry in Tally Prime

- Lec-20 Raw material convert into Finished Goods Entry in Tally Prime

- Lec-21 How to Adjust Gross Profit and Net profit by Closing Stock

- Lec-22 Partnership Firm Balance Sheet Scrutiny

- Lec-23 Match Electronic Cash Ledger in Tally Prime

- Lec-24 Match Electronic Credit Ledger in Tally Prime

- Lec-25 Match Input Tax Ledger in Tally Prime

- Lec-26 TDS & TCS adjust against Income Tax Payable

- Lec-27 Adjustment Entry in Partner Capital Account

- Lec-28 How to Prepare Balance Sheet From Trail Balance

- Lec-29 How to Prepare Profit and Loss Account

- Lec-30 Depreciation Calculation as Per Company Act 2013 (SLM Method)

- Lec-31 Depreciation Calculation as Per Income Tax Act(WDV Method)

- Lec-32 What is Deferred Tax Assets and How to Calculate

- Lec-33 Prepare Company Balance Sheet as Per Schedule III with Notes

- Lec-34 Prepare Profit and Loss Ac as per schedule III of Company Act 2013

- Lec-35 Cash Flow Statement

- Lec-36 OPC Company Registration and Document

- Lec-37 What is MOA and How to Draft MOA

- Lec-38 What is AOA and AOA Format

- Lec-1 Introduction of GST

- Lec-2 Feature of GST (Pan Base System)

- Lec-3 Supply under GST Part-1

- Lec-4 Transfer Assets without Consideration Supply Part-2

- Lec-5 Supply between related person or distinct persons Supply Part-3

- Lec-6 Charge of GST

- Lec -7 Introduction of RCM (RCM Part-1)

- Lec-8 Service Provide by GTA (RCM Part-2)

- Lec-9 RCM Entry in Tally Prime | RCM on Freight Charges Entry

- Lec-10 Place of Supply under GST

- Lec-11 Time of Supply

- Lec-12 Input Tax Credit Overview -Part-1

- Lec-13 Input tax Credit Part-2

- Lec-14 Input Tax Credit Part-3 Eligibility and Condition for taking ITC

- Lec-15 ITC Part-4 Apportionment of ITC [ Sec.17 (1)]

- Lec-16 ITC Part-5 Block Credit [Sec.17(5)]

- Lec-17 ITC Part-6 CREDIT IN SPECIAL CIRCUMSTANCES [SECTION 18]

- Lec-18 ITC Part-7 ITC Utilized and Rule 86B

- Lec-19 Exemption from GST

- Lec-20 GST Registration Part-1 Liable to Registration

- Lec-21 GST Reg. Part-2 Section 23 Person not Liable for Registration

- Lec-22 GST Reg. Part-3 Compulsory Registration Sec. 24

- Lec-23 Document Required for GST Registration

- Lec-24 GST Reg. Part-4 GST Registration Sec.25

- Lec-25 Practical GST Registration on Portal of Normal Taxpayer

- Lec-26 How to Reply GST Registration Notice

- Lec-27 First-Time Login on GST Portal with Provisional ID/ GSTIN and password?

- Lec-28 Add Bank Account Details after grant of Registration

- Lec-29 Reset of email address/ and mobile phone number of Authorized Signatory

- Lec-30 Casual Taxable Person Registration on GST Portal

- Lec-31 Extension of Registration Period for Casual Taxable Persson Form REG-11

- Lec-32 Amendment of GST Registration in Core and No Core Field

- Lec-33 ITC -01 Form File on GST Portal Sec 18(1)(C)

- Lec-34 Suo Moto Cancellation of GST Registration

- Lec-35 Cancellation of Registration (GST REG-16 )

- Lec-36 Revocation of Cancelled Registration

- Lec-37 How to Download GST Certificate

- Lec-38 E-Way Bill Part-1

- Lec-39 E-Way Bill Part-2

- Lec-40 Main Menu of E-way Bill

- Lec-41 E-Way Bill Portal registration

- Lec-42 Transporter Registration on E-Way Bill Portal

- Lec-43 Create E-Way Bill

- Lec-44 Update Part-B Vehicle

- Lec-45 Cancel E-way Bill

- Lec-46 Create Consolidated E-way Bill

- Lec-47 Reject E-Way Bill

- Lec-48 Extend E-way bill Validity

- Lec-49 Change to Multi vehicle

- Lec-50 Forget E-way Bill Portal Password

- Lec-51 Tax Invoice

- Lec-52 E-Invoice Part-1 Introduction

- Lec-53 E-Invoice Registration

- Lec-54 Forget Password and User Name on E-invoice Portal

- Lec-55 E-Invoice Generate and Cancel , Print E-Invoice

- Lec-56 MIS Report on E-Invoice Portal

- Lec-57 How to Generate E-Invoice by Tally Prime

- Lec-58 Nil rated or Exempted Goods ? What is Difference between Nil rated ,Exempted

- Lec-59 GST Return overview

- Lec-60 GSTR -1 Return Filling Part-1

- Lec- 61 GSTR -1 IFF (Invoices Furnishing Facility) (Part-1)

- Lec-62 GSTR-1 IFF Online Filling on Portal (part-2)

- Lec-63 GSTR-1 Quarterly File by Client Excel Data Part-3

- Lec-64 GSTR-1 IFF Filling by Tally Prime (Offline )

- Lec-65 GSTR-1 Quarterly Return Filling by Tally Prime

- Lec-66 Filing Nil Form GSTR-1 through SMS

- Lec-67 How to Opt QRMP Scheme from Monthly

- Lec-68 Search Tax Payer Details from GST Portal

- Lec-69 Find GST Number through PAN Number

- Lec-70 How to Add GST number on Portal (add to Master)

- Lec-71 What is GSTR2A and GSTR-2B ,Difference between GSTR2A and 2B

- Lec-72 GSTR-2b Reconciliation Tally Data Match with GSTR-2B in Tally Prime

- Lec-73 How to Download GSTR-2B from GST Portal in Excel

- Lec-74 How to Reconcile GSTR-2B with Tally Data by Pivot Table

- Lec-75 Invoice Management System under GST

- Lec-76 How to File GSTR-3B on GST Portal

- Lec-77 Authenticate Aadhaar and KYC Document in GST

- Lec-78 Section -51 of CGST Act

- Lec-79 TDS Deducted Entry in Tally Prime

- Lec-80 Deducted TDS Match with GSTR-7A Return

- Lec-81 How to File GSTR-7 TDS Return on GST Portal

- Lec-82 TDS Received Accept and Reject on GST Portal

- Lec-83 How to Download TDS Certificate in GST from Portal

- Lec-84 Transfer Amount From TDS Ledger to Electronic Cash Ledger

- Lec-85 What is Electronic Cash Ledger (ECL)and How to Download from GST Portal

- Lec-86 Electronic Cash Ledger Maintain in Tally Prime

- Lec-87 What is Electronic Credit Ledger and How to Download from GST Portal

- Lec-88 GST Match – Tax Liabilities and ITC comparison

- Lec-89 How to Maintain Credit Ledger in Tally Prime and Input tax Transfer to Credit Ledger

- Lec-90 Setoff Output Tax against Input Tax Entry in Tally Prime Part-1

- Lec-91 Setoff Output Tax against Electronic Credit and Cash Ledger in Tally Prime Part-2

- Lec-92 Reversal of ITC in GST ?

- Lec-93 Negative Liability Statement in GST

- Lec-94 GST on Rent ? Residential and Commercial Property

- Lec-95 GSTR-9 Part-1 Applicability & Basic of GSTR-9 for FY 23-24

- Lec-96 GSTR-9 Part-2 Penalty on Non Filing of GSTR 9 for FY 2023-24

- Lec-97 GSTR-9 Part-3 Overview of Tables of GSTR 9 FY 2023-24

- Lec-98 GSTR-9 Part-4. Optional Table in GSTR-9

- Lec-99 GSTR-9 Part-5 Table -4 Outward Supply

- Lec-100 GTSR-9 Part- 6. Adjustment in Table -4 Of FY 2023-24 in FY 2024-25

- Lec-101 GSTR-9 Part-7 Table No-5 Sales n which Tax is Not Payable

- Lec-102 GSTR-9 Part-8 Table No-6 ITC availed during the financial year

- Lec-103 GSTR-9 Part-9 Table 7-8 ITC Reverse and ITC Reconciliation

- Lec-104 GSTR-9 Part-10 Table No-9 Tax Paid as Declared in Return

- Lec-105 GSTR-9 Part-11 Table No-10,11,12,13 and 14

- Lec-106 GSTR-9 Part-12 Table No-15 & 16 Demand & Refund , Purchase from Composition Dealer

- Lec-107 GSTR-9 Part-13 Table No-17 HSN and SAC Wise Details

- Lec-108 GSTR-9 Part-14 Table No-18 and 19 Late Fees Payable Compute

- Lec-109 GSTR-9 Part-15 Practical Return Filling on GST Portal

- Lec-110 GSTR-9 Part-16 GSTR-9 Verify with EVC

- Lec-111 GSTR-9C Part-1 Applicability and Overview of GSTR-9C

- Lec-112 GSTR-9C Part-2 How to Download Offline Excel utility of GSTR-9C

- Lec-113 GSTR-9C Part-3 GSTR-9C Filling All Tables

- Lec-114 Composition Scheme under GST

- Lec-115 Composition Person Registration on GST Portal

- Lec-116 Opt for Composition Levy (FORM GST CMP-02)

- Lec-117 Withdrawal from Composition Levy (FORM GST CMP- 04)

- Lec-118 How to Activate GST in Tally Prime

- Lect-119 How to Create Tax , Purchase & Sales Ledger and Stock Item

- Lec-120 Record Purchase & Sales invoice under Composition Scheme

- Lec-121 RCM Entry and Increase Output Tax Liability in Tally Prime

- Lec-122 What is CMP -08 Form ? How to Calculate Tax Liability via CMP -08 form In tally Prime

- Lec-123 How to File CMP-08 form on GST Portal and Create Challan

- Lec-124 Create Tax Lability | Adjustment entry Output Tax Transfer to Expense |

- Lec-125 What is GSTR4-A for Composition Scheme

- Lec-126 How to file GSTR-4 on GST Portal

- Lec-127 GST PMT-09 Form Filling-1 ? How to Transfer Tax to other Head in Same GST Number in Cash ledger

- Lec-128 GST PMT-09 Form Filling-2 ? How to Transfer Tax to other Head in Other GST Number in Cash ledger

- Lec-129 How to File GSTR-7 TDS Return on GST Portal

- Lec-130 TCS under GST | TCS Deduction and Transfer to Electronic Cash ledger Entry in Tally Prime

- Lec-131 TDS and TCS credit received Form File on GST Portal

- Lec-132 ITC -01 Form File on GST Portal Sec 18(1)(C)

- Lec-133 Overview of Refund Excess Payment of Electronic Cash Ledger

- Lec-134 Refund in GST- ITC on Account of Exports without Payment of Tax

- Lec-1 Introduction of Income Tax

- Lec-2 How to Compute Total Income (Levy Of Tax)

- Lec-3 Slab Rate of Income Tax (old and New Tax Regime)

- Lec-4 What is Rebate u/s 87A and How to Apply

- Lec-5 Exempted Income- Agricultural Income

- Lec-6 Other Exempted Income

- Lec-7 Salary -Introduction of Salary

- Lec-8 Salary- Basis of Charge (section-15)

- Lec-9 Salary- What include in Salary

- Lec-10 Salary-HRA Exemption Calculation

- Lec-11 Salary- Pension Income and Exemption

- Lec-12 Salary -Gratuity Income and Exemption

- Lec-13 Salary-Leave Salary or Leave Encashment

- Lec-14 Salary -Sec. 10(10B) Retrenchment Compensation & Voluntary Retirement Sec.10(10)

- Lec-15 Salary-Allowance and Exemption u/s 10(14)

- Lec-16 Salary-What is Perquisite ?

- Lec-17 Salary-Rent Free Accommodation Valuation

- Lec-18 Salary-Motor Car Valuation

- Lec-19 Salary-Leave Travel Allowances Sec.10(5)

- Lec-20 Salary-Calculate Relief u/s 89(1) Arrear of Salary

- Lec-21 Salary-10E Form File on Income Tax Portal

- Lec-22 Salary-Taxation of Employee Provident Fund

- Lec-23 Salary-Deduction from Gross Salary u/s 16

- Lec-24 HP-Basic Concept of HP Income

- Lec-25 HP-Property as stock in Trade

- Lec-26 HP-Income do not charge to House Property Head

- Lec-27 HP-Computation of House property Income

- Lec-28 HP-Interest on Borrowed Capital Deduction u/s 24(b) and 24(a)

- Lec-29 HP-HP partly Self-Occupied & partly Let-out | Taxation of Independent Residential Units

- Lec-30 HP-Unrealized Rent subsequently Realized & Arrear of Rent | Sec. 25A

- Lec-31 HP-Taxation of House Property owned by Co-owners(joint Property) Sec. 26

- Lec-32 HP-Composite Rent of House Property

- Lec-33 HP-Revision

- Lec-34 HP-Practical Question

- Lec-35 PGBP-Basis of Charge Sec. 28

- Lec-36 PGBP-Taxation of Export Incentives to Exporters (Sec.28)

- Lec-37 PGBP-Payment to Partners of Firm in Business (Sec.28)

- Lec-38 PGBP-Conversion of inventory into capital assets (Sec.28)

- Lec-39 PGBP-Speculative Transaction (Share Market Income) under PGBP (Sec.28)

- Lec-40 PGBP-Business Income not Taxable under PGBP Head

- Lec-41 PGBP-Rent, Taxes & Repair of Building Sec. 30

- Lec-42 PGBP-Deduction of Expenditure on Specified Business Sec. 35AD

- Lec-43 PGBP-Amortization of Preliminary Expenses Sec. 35D & Expenditure on Voluntary Retirement Sec. 35DDA

- Lec-44 PGBP-Deduction of Insurance Premium, Discount on Zero Coupon Bond Sec.36

- Lec-45 PGBP-Contribution to PF Employee [sec.36(1)(va)] and Employer[36(1) (iv)]

- Lec-46 PGBP-Bad debt and provision for bad Debts [Sec.36(1)(vii)] & Bad debt Recovery

- Lec-47 PGBP-General Deduction under PGBP | Sec. 37(1)

- Lec-48 PGBP-Disallowances on default of TDS payment to Non-Resident | Sec. 40(a)(i)

- Lec-49 PGBP-Default of TDS in case of payment to Resident | Sec. 40(a)(ia)

- Lec-50 PGBP-Maximum Permissible Remuneration and Interest to Partners | Sec. 40(b)

- Lec-51 PGBP- Excessive Payment to Relative Disallowed | Sec. 40A(2)

- Lec-52 PGBP-Cash Expenditure Exceeding Rs. 10,000 Disallowed | Sec. 40A(3)

- Lec-53 PGBP-Expenses Deductible on Payment Basis | Sec. 43B and 43CA

- Lec-54 PGBPP-Payment to MSME Registered Disallowance u/s 43b(h)

- Lec-55 PGBP-Restriction on Accepting and Repaying Loan in Cash | Sec. 269SS & Sec. 269T & 269ST

- Lec-56 PGBP-Depreciation under Sec. 32

- Lec-57 PGBP-Unabsorbed Depreciation Sec. 32(2) | Set-off & Carry-forward of Unabsorbed Depreciation

- Lec-58 PGBP-Maintenance of Books of Account of Business or Profession | Sec. 44AA

- Lec-59 PGBP-Audit under Income Tax | Sec. 44AB

- Lec-60 PGBP- Presumptive Taxation for Business Sec. 44AD

- Lec-61 PGBP-Presumptive Taxation for Professional Sec. 44ADA & Transporter 44AE

- Lec-62 CG-What is Capital Assets ? Sec. 2(14)

- Lec-63 CG-Type of Capital Assets (Short Term and Long Term)

- Lec-64 CG-What is Transfer Sec.2(47)

- Lec-65 CG-Transaction not regarded as Transfer

- Lec-66 CG-Capital Gain exempt under Sec. 10

- Lec-67 CG-How to Calculate Short and Long Term Capital Gain

- Lec-68 CG-Exemption U/s 54,54B and 54D

- Lec-69 CG-Exemption u/s 54EC and 54F

- Lec-70 CG-Capital Gain Account Scheme

- Lec-71 CG-Calculate CG on Sale of Residential House Property

- Lec-72 CG-Calculate CG on Sale of Land (agriculture(Rural and Urban) & Commercial Land)

- Lec-73 CG-CG on Sale of Equity Share and Equity Oriented Mutual Fund

- Lec-74 CG-CG on Sale of Bond and Debenture

- Lec-75 CG-CG on Sale of Gold and Jewelry

- Lec-76 CG-CG on Depreciable Assets (Business Assets)

- Lec-77 OS -Income from Other Sources Part-1

- Lec-78 OS- Income From Other Sources Part-2

- Lec-79 Setoff and Carry forward of Losses Part-1

- Lec-80 Setoff and Carry forward of Losses Part-2

- Lec-81 Clubbing of Income

- Lec-82 General Deduction u/s 80C & 80D

- Lec-83 General Deduction u/s 80DD to 80U

- Lec-84 How to Calculate Tax Payable Amount

- Lec-85 Advance Tax

- Lec-86 How to calculate Advance Tax

- Lec-87 How to Pay Advance Tax via Challan

- Lec-88 Mandatory Returns Filling Sec. 139(1)

- Lec-89 Filing of Return in the case of a loss –u/s 139(3)

- Lec-90 Belated Return u/s 139(4) and Revised Return u/s 139(5)2

- Lec-91 ITR filing due dates for FY 2024-25 (AY 2025-26)

- Lec-92 How to Apply New Pan Card online

- Lec-93 Required Document for Income Tax Return

- Lec-94 Which Return have to file ?

- Lec-95 What is 26AS Form and How to Download From Income Tax Portal

- Lec-96 What is AIS and How to Download from Portal

- Lec-97 How to Apply New Pan Card online

- Lec-98 How to Registered on Income Portal

- Lec-99 How to Reset Income Tax Login Password

- Lec-100 Income Tax Portal Overview

- Lec-101 ITR-1 Filling though Form 16 (New Tax Regime)

- Lec-102 ITR-1 Filling without Form 16 (New Tax Regime)

- Lec-103 ITR-1 Filling (Old Tax Regime) Part-1

- Lec-104 ITR-1 Filling (Old Tax Regime) (Part-2)

- Lec-105 How to Download offline utility from Income Tax Portal

- Lec-106 How to Download Prefilled Data and import

- Lec-107 Which Schedule have to Select For ITR Filling

- Lec-108 Schedule -1 General Information Part-1

- Lec-109 Schedule -2 General Information part-2

- Lec-110 Schedule -3 How to Fill Details in Balance Sheet Schedule

- Lec-111 Schedule-4 Trading & Profit and Loss Account

- Lec-112 Schedule-5 Other Information for Business

- Lec-113 Schedule -6 Quantitative Details

- Lec-114 Schedule-7 Part-1 Income From Business and Profession

- Lec-115 Schedule 7 Part -2 BGBP Share Market Income Part-1

- Lec-116 Schedule 7 Part -3 BGBP Share Market Income Part-2

- Lec-117 Schedule -8 Depreciation on Fixed Assets

- Lec-118 Schedule-9 Capital Gain Part-1 Sale of Land & Building

- Lec-119 Schedule-9 Capital Gain Part-2 Mutual Fund (Short & Long Term ) + VDA Income

- Lec-120 Schedule -10 Income Form Other Sources Head

- Lec-121 Schedule-11 Current year Losses setoff against Current Year Income

- Lec-122 Schedule-12 Brought forward Losses and Current Year Losses to be Carry forward

- Lec-123 Schedule -13 GST Schedule and Other Schedules

- Lec-124 Schedule-14 Gross Total Income, Tax Paid and Income Tax Payable Schedule

- Lec-125 ITR-2 Return Filling Part-1

- Lec-126 ITR-2 Return Filling Part- 2

- Lec-127 Salary + Agriculture Income | ITR-2 Filling

- Lec-128 ITR-3 Filling Part-1

- Lec-129 ITR-3 Filling Part-2

- Lec-130 ITR -4 Filling with Excel utility For FY 24-25

- Lec-131 ITR-4 Filling FY 24-25 Online , Computation & Balance Sheet

- Lec-132 ITR -5 Filing Partnership Firm on Income Tax Portal

- Lec-133 ITR-6 Filling

- Lec-134 ITR-U -File Updated Return (ITR-U) Part-1

- Lec-134 ITR-U-File Updated Return (ITR-U) Part-2

- Lec-135 How to ITR-U Late Fee Payment on Portal

- Lec-136 Update Return error

- Lec-137 How pay Income tax on Income Tax Portal

- Lec-138 Defective Return Return u/s 139(9) Part-1

- Lec-139 How to Reply Defective Return Notice u/s 139(9)

- Lec-140 Tax Audit (3CD ) Filling

- Lec-1 What is TDS and TCS ? TDS Overview

- Lec-2 TDS Section 192A,193,194,194A,194B and 194BB,

- Lec-3 TDS Section-194C,194D,194DA,194G,194H,

- Lec-4 TDS Section – 194I,194IA,194IB,194J,194M,194N,194T

- Lec-5 Interest and Penalty of Late Payment and Late return File

- Lec-6 What is TCS and Rate of TCS

- Lec-7 TDS Entry in Tally Prime

- Lec-8 TDS Working in Excel for Challan and Return

- Lec-9 How to Apply TAN Number Online

- Lec-10 How to Verify PAN Active or Not

- Lec-11 How to Pay TDS & TCS Online

- Lec-12 How to Download CSI File and Challan from Portal

- Lec-13 Types of TDS Return

- Lec-14 How to Download TDS Return RPU Java Utility

- Lec-15 Prepare Computation in Excel for 26Q Return

- Lec-16 26Q TDS Return Filling Online

- Lec-17 26QB Return Purchase of Immovable Property

- Lec-18 Prepare Estimated Salary Working Sheet for FY 2025-26

- Lec-19 Calculate TDS on Salary with Excel Calculator For FY 24-25

- Lec-20 24Q Return Filling Part-1 Annexure -1

- Lec-21 24Q Return Filling Part-2 Annexure II

- Lec-22 What is 15G and 15H form and File

- Lec-23 How To Registered TAN on TDS Traces Portal

- Lec-24 How to Reset Password on Traces Portal

- Lec-25 Forget User ID on Traces Portal

- Lec-26 How to Download Form 16 and Form 16A from Portal

- Lec-27 How To Correction Challan on Traces Portal

- Lec-28 Overview about Traces Portal

- Lec-29 Registration as Taxpayer on Traces Portal

- Lec-1 Overview of Payroll

- Lec-2 How to Activate Payroll in Tally Prime

- Lec-3 How to Create Employee Group

- Lec-4 How to Create Employee Name Signal and Multiple

- Lec-5 How to Create Single and Multiple Unit (work)

- Lec-6 How to Create Attendance /Production Type

- Lec-7.Create Employee Earning Pay heads

- Lec-8 Create Employee Statutory Deduction by Employer

- Lec-9 Create Employer’s Contribution Pay Heads

- Lec-10 Other Deduction Pay heads from Employee Salary

- Lect-11 Define Salary Structure for Employees and Employee Groups

- Lec-12 Create Attendance or Production Vouchers

- Lec-13 Calculate Monthly Salary Payable

- Lec-14 Income Tax Declarations in Tally Prime

- Lec-15 Employer Contribution and Payment

- Lec-16 Advance Salary and Setoff against Salary Payable

- Lec-17 TDS on Salary and Provide Form 16

- Lec-18.How to Prepare Salary Sheet in Excel

- Lec-1 What is CMA DATA and Project Report

- Lec-2 CMA DATA Document

- Lec-3 Profit and Loss Ac and Balance Sheet

course completion certificate

Why Students Love KSR Academy

Whether it’s a first brush on canvas or the last frame in an animation, Skillshare is here to support you on every step of your creative journey.

Awesome teaching ...“Thank you, sir, for being so interactive with us that the concepts that seem so difficult in the textbooks begin to feel easy and applicable when you teach them.Thanks to KSR academy

Sandip Malge

The way of teaching of KSR Academy was just a extraordinary experience for me.... I always suggest for any interested students want to join in a courses of Tax Consultant.... Please prefer first KSR 👍👍❤

Bishikeshan Ratha

Hello sir 1st off thank you so much sir for such a wonderful course with affordable price for such students who are not able to afforded such course due high price in market. The way you teach was best very concept get crystal clear you are best teacher for this course . Thank you sir.

Poonam Narawade

Here is the best class for GST taxation and accounting.Here karan sir your teaching technique is good from very basic and advance knowledge level. This knowledge will help me to brighten my future. Thank you ou so much Karan sir..

Akshaykumar nigade

Awesome teaching and the Best class for GST , Taxation and Accounting. Karan Sir is very helpful and interactive Person. It is so easy to understand difficult concepts through your interactive classes. He helps Always after the class also and clears all the doubts. ❤️"I Proud To Be A Part Of KSR Academy".💐 Thanks to KSR Academy🙏🏻

AMIT KUMAR

Very nice experience. This is a fully knowledgeable course. In this course you can understand all things regarding tax consultant and accountancy from beginner to advance level.

Nitesh Singla

Nice Teaching with each and every subject of accounting and taxation with fully understood, systematic training in practical and theoretical knowledge, Teacher must to solve the all types of problems and our queries with proper explanation helping in accounting and taxation. Nice class with excellent experience with this class.

Ajinkya dhawale

Frequently Asked Questions

Click on Enroll Now Button. > Clicking the Course Page will Open> Click on Get this course. > Fill Detail and Verify Mobile number with Mobile OTP. > Make payment via UPI, Debit card and Credit Card> After payment you will get access immediately.

Yes ! You can Download Videos in Mobile Application, You Can watch it in Offline Mode without Internet.

For Laptop or PC Visit www.ksracademy.com >click on Login > Enter your Registered mobile number > Verify OTP with Registered Mobile Number.

Yes ! you will have our WhatsApp support.

The validity of the course is Life time.

Yes, you will get Accounting, Tally Prime eBook and practice file.

Yes ! You will Get A Certificate.

There is No Refund Policy.

There will be a live doubt session Monday to Friday 8PM.

Get Bonuses Worth ₹ 8,500 with this Course

Excel Mastery Course

Basic Excel with Pivot Table, V lookup , H-Lookup and many Advance Formula

Word Mastery Course

Microsoft Word with Basic to Advance Letter Writing , Printing option etc

Power point Mastery Course

Power Point Presentation Prepare Create Youtube Thumbnail, Instragram Post